Lower tax rate, higher tax bill in Travis County’s draft budget

Wednesday, August 5, 2015 by

Caleb Pritchard Travis County’s property tax rate is expected to dip during the next budget cycle, but taxpayers shouldn’t necessarily expect lower bills.

According to the preliminary budget for Fiscal Year 2016, the rate will drop by 6.62 percent. However, rising property values mean that the owner of a home with the average taxable value of $262,199 will pay $22 more on the tax bill compared to this year.

That increase would appear to wipe out most of the savings the median Austin homeowner could hope to see from the 6 percent homestead exemption approved by City Council back in June.

However, in addition to the routine mysteries surrounding a preliminary budget, county staff’s predictions are made even more tenuous thanks to the city’s ongoing challenge of the Travis Central Appraisal District’s commercial property valuations. Several major TCAD taxing entities declined to join that challenge, including Travis County.

“One of the things that made us really, really nervous on challenging (TCAD) was what it was going to do to their operations, to where they would feel comfortable enough to give us info that we felt comfortable with,” Travis County Commissioner Gerald Daugherty said on Tuesday. “So, this is really shaky ground.”

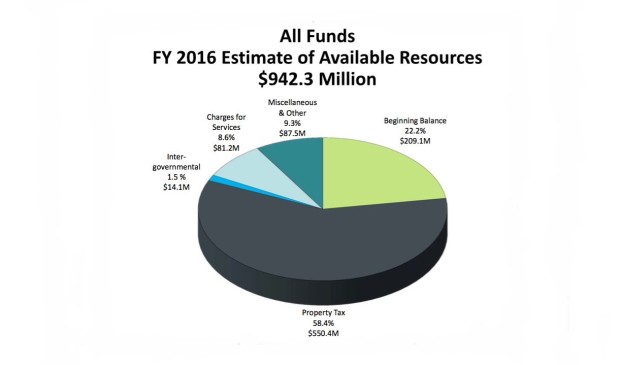

The challenge delayed TCAD’s tax roll certification from July 21 to likely the end of August. Until then, Travis County budget writers are trucking ahead with a budget that, at $942 million, is $31 million larger than last year’s.

The lion’s share of that increase comes from a $22 million bump in property tax revenue, which is predicted to come despite a significant tax relief measure enacted by the court.

This summer, the commissioners voted to increase an exemption for seniors and disabled homeowners from $70,000 to $75,000. According to staff, that measure should shield eligible homeowners in the average homestead from rising tax rates due to higher valuations.

The county can also credit its swollen coffers to rising revenues from other sources, including vehicle registration fees and the mixed beverage tax, which together amount to an extra $5.3 million.

“They might be complaining about taxes, but they’re still drinking,” Budget Director Jessica Rio County Auditor Nicki Riley told the commissioners.

“You stole my line,” Commissioner Ron Davis quipped.

Public safety, jails and justice programs make up the plurality of the preliminary budget. Combined, they could account for a total increase of more than 7 percent, or $8.3 million, compared to 2015.

The county is also accounting for $95.9 million in debt service next year. That includes $47.9 million to pay down certificates of obligation issued for unbuilt capital projects such as the Ronnie Earle Building and the Medical Examiner’s Office building.

As for the region’s red hot economy, county staff is predicting a slowing of its momentum next year.

According to the executive summary in the preliminary budget: “Factors such as job and population growth as well as the continuing diversification of the economic base in Travis County and the region lead to an optimistic economic outlook, especially in comparison to many other regions in the nation.

“However, this optimism must be balanced against housing affordability and transportation concerns, among an array of other challenges, as policy makers are challenged on how to best manage this growth.”

The Commissioners Court is set for another budget hearing this Thursday. The first public hearing on the new tax rate is scheduled for Tuesday, Sept. 22. The court will vote on formal adoption on Tuesday, Sept. 29.

This story has been corrected

Graph courtesy of Travis County.

You're a community leader

And we’re honored you look to us for serious, in-depth news. You know a strong community needs local and dedicated watchdog reporting. We’re here for you and that won’t change. Now will you take the powerful next step and support our nonprofit news organization?